MTF Finance has today reported a net profit after tax of $11.6m for the 12 months to 30 September 2023, up 38% on the previous year, with lending assets increasing by 32% to $1.010bn. Underlying profit after tax has increased by 71% to $11.3m with total lender earnings up 27% to $85.5m.

This result reflects the continued focus on community lending and expanding its vehicle dealer network and digital offering. The outcome is a stellar year for MTF Finance lenders, in which they have been able to support more New Zealanders to access safe lending solutions than ever before, and projects the company into the top tier of non-bank lenders.

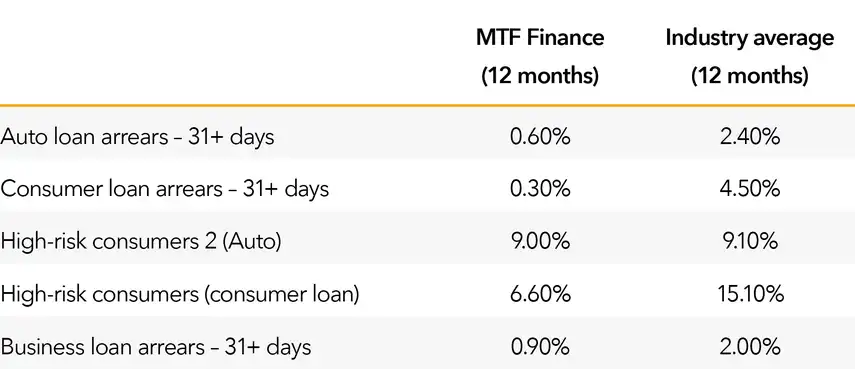

This unique community-based lending model where MTF Finance franchises and vehicle dealers make the lending decision, recorded record low arrears at less than half the industry average, which is a strong measure of how the company’s lending approach creates better customer outcomes and supports customers over the long-term, not just when they first get the loan.

It has also supported a record growth year that has delivered unprecedented momentum, with lending up 40% year-on-year to $846m, up from $607m in September 2022.

Chief Executive Officer, Chris Lamers, says: “As a New Zealand-owned and operated organisation, MTF Finance has a proud history spanning more than 50 years and we are focussed on helping New Zealanders get ahead by making lending about people again. Today's result demonstrates the important role that MTF Finance plays within its communities, and comes at a challenging time when many New Zealanders are feeling the effects of recent interest rate rises and the increased cost of living.”

The combination of strong lending growth and well-managed operating expenses allowed the company to hold interest rates as low as possible for customers, as well as deliver record returns to lenders.

MTF Finance Chair, Mark Darrow, says: “Key to achieving this was a clear strategy designed to deliver growth and resilience during a tough economic climate. We grew our reach, adding franchises to reach a total of fifty-one around the country, with two more opening in November, bucking the trend when others are closing local branches. We also grew the motor dealer channel with more focus in this area and completed a Fintech acquisition. It has been a busy and successful year.

“Systems improvement and enhanced product offerings featured new digital products, underpinned by our conservative approach to credit.”

The purchase of The Lending People in February 2023 gave customers access to a new online digital lending channel, while franchise branches continued to provide dedicated financial advice and solutions at a local level.

“The insurance partnerships initiated this year with AMI and Tower have been a welcome addition to the incumbent offering with Autosure. These product offerings allow MTF Finance to become a one-stop shop for our customers, growing the business and taking the pain out of the customer having to secure these services for themselves,” adds Lamers.

“Our local communities and our customers sit at the heart of how MTF Finance operates, and backing local businesses and communities does so much more than just help the economy - it builds connections, strengthens our neighbourhoods, and makes New Zealand stronger by making finance more accessible to everyday Kiwis. Our owner-operators, including our franchisees and vehicle dealers, make the lending decision in the best interests of the customer, meaning not only do they get personal and fast service, they know we will be there whenever they need us.”

Lamers says the current economic cycle has placed increasing pressure on households nationwide, and MTF Finance is focused on helping customers in financial need. The company took proactive steps to provide customers with practical tools and guidance to help them make well-informed money-related decisions, which have been borne out by the company having industry-leading low levels of loan arrears. This was also evident during Cyclone Gabrielle where the company rallied to support the impacted communities guided by our owner-operators who live in the same communities.

"MTF Finance’s goal is to be New Zealand’s most chosen and loved finance company and we are delighted by the ratings our customers give us."

Looking forward, Lamers says the company will continue to be close to its customers, to ensure it is proactive in looking after customers as economic conditions continue to harden with increases in wholesale interest rates and inflation fuelling a cost-of-living crisis.

The company plans to launch the brokering of home loans through its franchise network and will continue to enhance its product offering through both existing and new partnerships. There will be an increased focus on community engagement through an evolving Environmental Social and Governance (ESG) strategy.

Financial overview

- Net interest income and fees have increased 32% to $11.1m

- Operating expense ratio has decreased by 1%

- Profit after tax has increased 38% to $11.6m

- Underlying profit after tax has increased 71% to $11.3m

- Total originator earnings has increased 27% to $85.5

Arrears statistics

The importance placed on supporting the communities we live and work underpins the strong loan performance.

Auto loan arrears exceeding 31 days stand at 0.6% against an industry average of 2.4%, with business loan arrears calculated at the same benchmark currently tracking at 0.9% against the industry average of 2%. Consumer loan arrears with MTF Finance over the last 12 months are considerably lower than the industry average of 4.5% at 0.3%, with high-risk consumer loan arrears 6.6% against the industry average of 15.1%.

Customer satisfaction scores

MTF Finance scores highly on Net Promoter Score, a key identification of customer satisfaction, with 2022 evaluations at 79 points against an industry average of 44. More than 10,000 Trustpilot customer reviews give MTF Finance 4.9 out of a score of five for customer satisfaction.

Media contact

Johnny Shaw, Anthem

About MTF Finance

Established in 1970, MTF Finance is 100% Kiwi-owned and one of New Zealand’s most trusted finance companies.

We provide innovative finance solutions to New Zealanders through our 53-strong franchise network, vehicle dealers and partners such as Trade Me. This has helped us grow into a business with assets of more than $1B.

We are launching new products and partnerships while staying true to our core; that we are people helping people, powered by a world-class funding system.