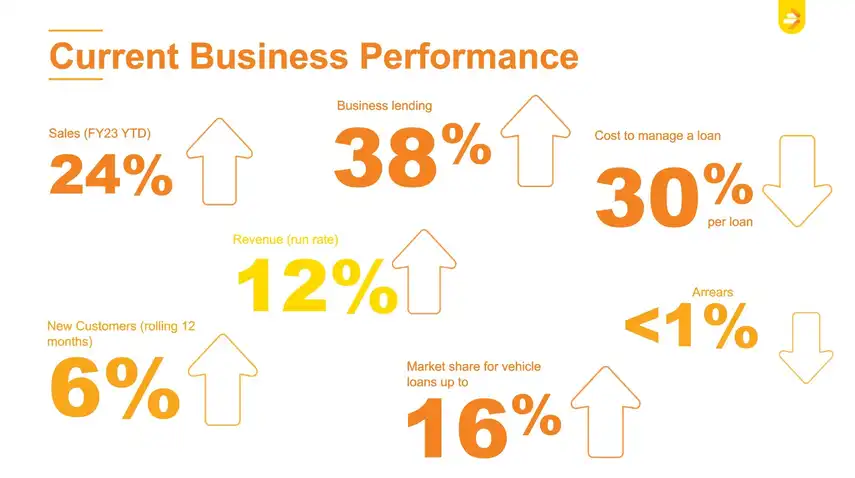

CEO Chris Lamers says, "It has been a challenging year for many kiwis, from rising living costs to unexpected and catastrophic weather events. Yet, despite this turbulence, we have seen our new customers grow by 6 per cent, and market share in our core business of vehicle loans grow from 10 to 16 per cent. Our new personal lending product has helped MTF Finance pick up a 4.6 per cent share in the large personal lending market ."

Board Chair Mark Darrow says, "We are seeing the business plan brought to life through the excellent delivery of new products, technology and innovation, leadership recruitment and the formation of new business partnerships."

New partnerships with AMI, Tower insurance and MTA have helped MTF Finance reach new customer segments to provide a wider range of products, complementing their continued partnerships with Autosure and Trade Me.

Added Lamers. "It is rewarding to partner with reputable brands who recognise our competitive advantage as a community-based organisation that makes lending about people again. Our network of business owners, dealers and franchises can make lending decisions on the spot. That is a powerful proposition for customers looking to get ahead with expert lending support."

"We know New Zealanders want personal service, and whether that be with one of our local franchises, a vehicle yard or online, our customer service model is unique, which is driving our growth."

At yesterday's annual meeting, shareholders re-elected incumbent director and deputy chair Stu Myles for a second term as director.

Added Darrow, "The MTF Finance Board, management and staff would like to congratulate Stu on his re-election and look forward to continuing to work together to progress the future strategy and direction of the company.

Lamers further adds, "Our business is building momentum. We recently secured a market-leading capital issuance of $280m to help fund the growth. This has allowed us to grow receivables this financial year at an annualised rate of 28 per cent to $864m, as of March 2023. It also takes a great team of people working hard behind the scenes. To lead them, we recently hired a new Chief Technology Officer, a new Chief Commercial Officer, and a new Head of Credit and appointed a Deputy CEO. At the same time, we have retained key talent to blend new thinking and energy with experience and long-term belief to continue building business performance into 2023".

Read more stories

Annual Report 2025

MTF Maintains Record Performance and Customer Leadership Amid Economic Headwinds

Investing in people continues to pay off for MTF Finance shareholders. The company has posted another year of strong performance and strategic progress, maintaining record originator earnings of $91.6 million, industry-leading customer satisfaction and low arrears.

Watch the video of Chris Lamers, MTF Finance CEO, candidly discuss the 2025 Annual Report.