During this period, the business has:

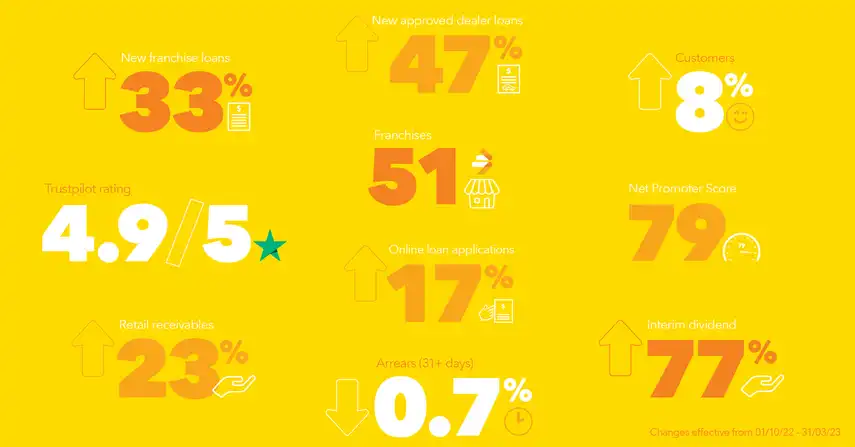

- Grown retail receivables 23% year on year from $763m to $879m

- Increased the number of customers by 8%

- Underlying profit after tax up by 117% to $6.2m

- Interim dividend up 77%, reflecting an annualised dividend yield of 6%

- Arrears (31+ days) remain at an exceptionally low level of 0.7%

- Launched additional franchise locations and grown its dealer network by 23%

Says CEO, Chris Lamers, “MTF Finance has experienced a period of growth well above what the market has grown at. While numerous businesses are adopting a conservative approach and scaling back, we continue to have confidence in our distinctive community-based lending model. As a result, we have successfully assisted a greater number of New Zealanders, setting us apart in these uncertain times. During these challenging times, our customers rely on us to be there for them, and we are unwavering in our dedication to the communities we serve. We remain committed to supporting them through both prosperous and difficult periods, demonstrating our steadfast commitment to their well-being."

Says Board Chair, Mark Darrow, “Combined with a clear strategy that the Board put in place almost two years ago, and a strong focus on action that benefits the customer, MTF Finance has been able to attract new customers and increase retention of existing customers. The Board is now focussing on the next three years and how we build on this momentum."

Lamers adds, “Our franchise and dealer network operates within the communities they serve, resulting in a distinctive and unparalleled commitment to customer service. Unlike other finance companies, we offer a remarkable promise: the opportunity for all customers to directly communicate with the business owner and key decision-maker, rather than navigating through automated call trees. This personal touch sets us apart, ensuring a more responsive and tailored experience for our valued customers."

"This personal touch sets us apart, ensuring a more responsive and tailored experience for our valued customers."

While the economic outlook is uncertain, MTF Finance is confident of continued strong performance in the second half of the financial year.

“We have worked on reducing the cost to run the business, which is now at record lows as a ratio of income. We have increased access to funding and capital and are confident we can maintain this strong growth rate. We have entered the personal loan market, which is showing strong growth, and through partnerships, we have expanded our insurance offer. We have a strong roadmap of new products, partnerships and locations to expand into that we expect to continue to grow despite the economic environment."

Arrears continue to trend lower than pre-covid levels, now at 0.7%, showing the strong focus on loan quality and ensuring that customer care is prioritised to create great customer outcomes, all in the pursuit to make lending about people again.

Media contact

Chris Lamers

CEO

027 4555 601

About MTF Finance

Established in 1970, MTF Finance is 100% Kiwi owned and one of New Zealand’s most trusted finance companies.

We provide innovative finance solutions to New Zealanders through our 51-strong franchise network, vehicle dealers and partners such as Trade Me. This has helped us grow into a business with assets of more than $972m.

We are launching new products and partnerships while staying true to our core; that we are people helping people, powered by a world-class funding system.

Read more stories

Annual Report 2025

MTF Maintains Record Performance and Customer Leadership Amid Economic Headwinds

Investing in people continues to pay off for MTF Finance shareholders. The company has posted another year of strong performance and strategic progress, maintaining record originator earnings of $91.6 million, industry-leading customer satisfaction and low arrears.

Watch the video of Chris Lamers, MTF Finance CEO, candidly discuss the 2025 Annual Report.